2020-2030 globla market for lithium Battery manufacturers

After the lithium salt manufacturers postponed their capacity expansion plans in 2019, the lithium market is expected to resume supply and demand balance in 2020. In the near term, BNEF believes that the spot price of lithium carbonate in China is close to the current USD 7,000 / ton LCE, and the price of lithium hydroxide is close to USD 8,500 / ton LCE. If the Chinese electric vehicle market unexpectedly recovers strongly in the second half of this year, lithium salt prices may rise accordingly. However, if the impact of the new coronavirus epidemic continues into the second quarter of this year, lithium carbonate prices may fall below $ 7,000 / tonne LCE.

In 2020, China’s passenger car sales may be only 1.2 million units, and lithium salt demand will be less than 300,000 tons of LCE. The Chinese government is considering introducing policy measures to boost sales of electric vehicles, including delaying the decline of subsidies for new energy vehicles.

Until 2030, although the acceleration of refining capacity recovery faces the risk of increasing environmental costs and there is also demand, South American integrated brine extraction lithium manufacturers still produce the lowest cost of lithium carbonate in the world. The current lithium hydroxide production model is to export Australian spodumene to Chinese refineries, while achieving integrated production in Australian lower cost refineries, or processing industrial grades produced in Latin America in other Asian countries (such as Japan and South Korea) Lithium carbonate has the potential to disrupt current production models.

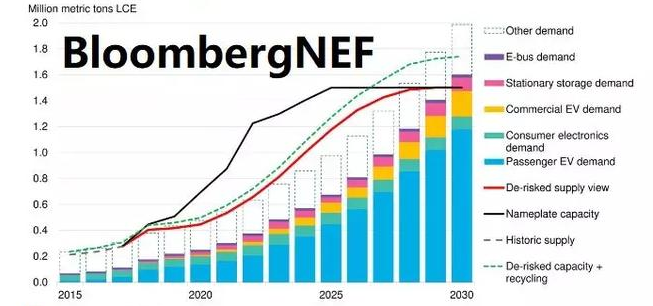

BNEF predicts that the lithium market demand (including battery and non-battery demand) in 2030 will be 2 million tons of LCE, and the lithium concentrate production capacity currently under construction cannot meet such a large demand. The improvement of battery recycling technology can bring about 24.1 tons of LCE recycling capacity, which will help maintain the market balance to 2029.

By the end of fiscal 2018, lithium salt manufacturers tracked by Bloomberg had attracted a total of USD 36.5 billion in investment through debt investments, equity investments or mergers. A large part of it was originally planned for capacity expansion. However, the investment in the lithium market is clearly insufficient to support lithium salt demand in 2030. BNEF estimates that lithium salt manufacturers will need to invest an additional 25 to 30 billion US dollars in the next ten years in order to meet the 2030 market demand for lithium capacity.

If interested to know more details information,Please kindly find:https://www.hrl-battery.com

Post time: Mar-12-2020